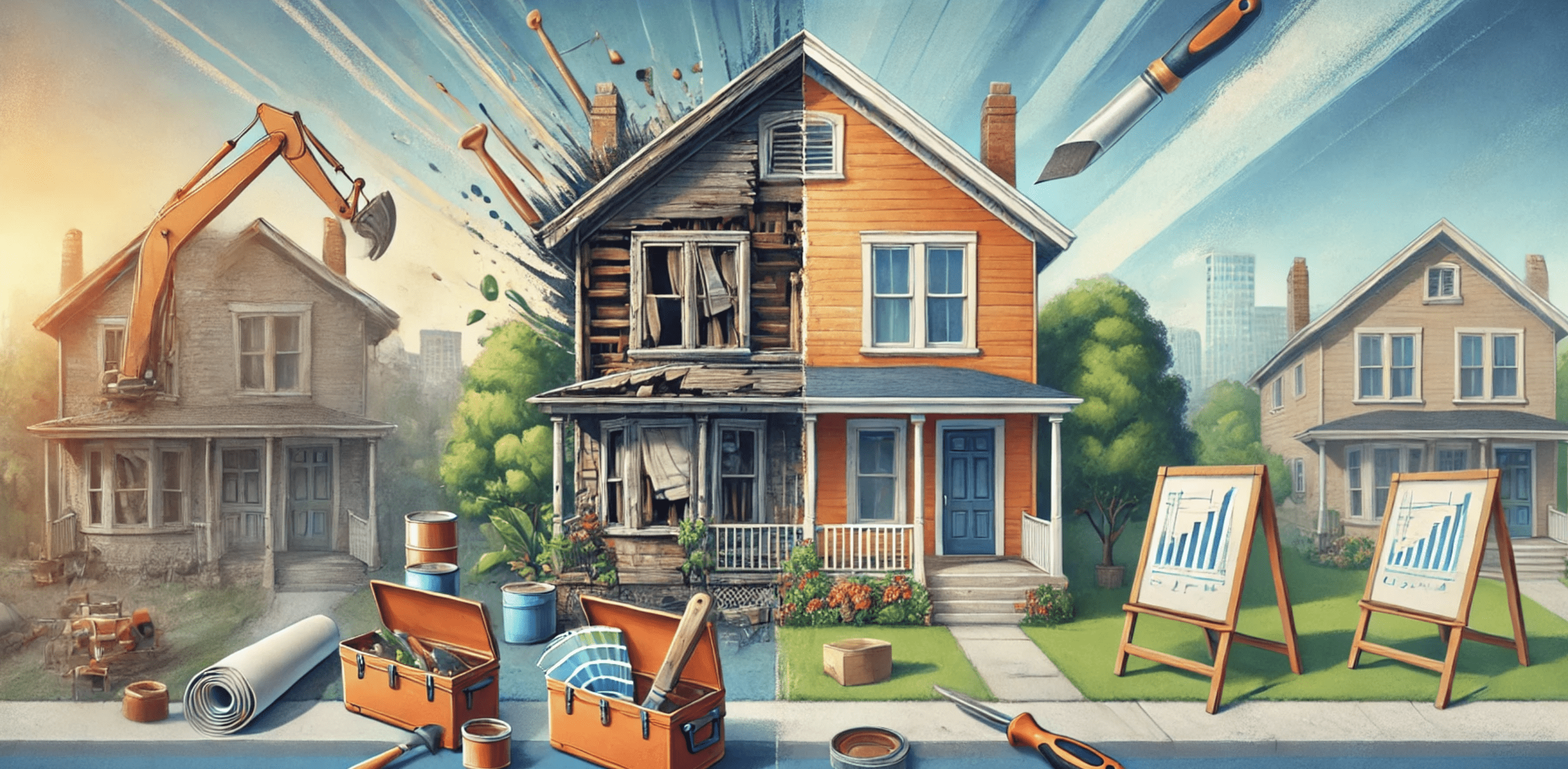

The BRRRR strategy, which is short for Buy, Rehab, Rent, Refinance, Repeat, is a powerful method for building a substantial real estate portfolio. This investment strategy allows you to recycle your capital, thereby maximizing your returns and accelerating your portfolio’s growth. Let’s dive into each step of the BRRRR method and see how it can help you achieve your real estate investment goals.

1. Buy

The first step in the BRRRR strategy is to buy a property with investment potential. The key to success in this step is to purchase properties below market value, often distressed or in need of significant repairs. Identifying such properties requires diligent research, networking with local real estate agents, and staying informed about foreclosures, auctions, and other opportunities for acquiring undervalued properties.

Tips for Buying:

- Look for motivated sellers who need to sell quickly.

- Analyze the local real estate market to identify areas with growth potential.

- Perform thorough due diligence to ensure the property has no hidden issues.

2. Rehab

Once you’ve acquired the property, the next step is to rehab or renovate it. The goal here is to increase the property’s value through improvements and repairs. This could involve anything from cosmetic upgrades, like painting and flooring, to more extensive, structural renovations, like kitchen and bathroom remodels.

Tips for Rehabbing:

- Create a detailed renovation plan and budget.

- Hire reputable contractors with experience in the type of work required.

- Focus on improvements that add the most value to the property, such as modernizing the kitchen, updating bathrooms, and enhancing curb appeal.

3. Rent

After the property has been rehabbed, the next step is to rent it out. Renting the property provides a steady income stream and improves the property’s cash flow, which is essential for the next step in the BRRRR strategy.

Tips for Renting:

- Screen tenants thoroughly to ensure they have a good rental history and stable income.

- Set a competitive rental price based on market research to attract quality tenants quickly.

- Consider hiring a property management company if you prefer a hands-off approach to managing tenants and maintenance.

4. Refinance

Once the property is rented out and generating income, the next step is to refinance. Refinancing involves taking out a new mortgage on the property, ideally at a higher valuation due to the improvements and rental income. The goal is to pull out the equity you’ve created through the rehab process, allowing you to recover your initial investment.

Tips for Refinancing:

- Work with a lender experienced in investment properties.

- Ensure your property is appraised at a high value by showcasing the renovations and rental income.

- Use the funds from the refinance to pay off any existing loans or reinvest in new properties.

5. Repeat

The final step in the BRRRR strategy is to repeat the process. With the capital recovered from refinancing, you can reinvest in another property and start the cycle again. By continuously repeating this process, you can rapidly grow your real estate portfolio, leveraging each property’s equity to acquire more assets.

Tips for Repeating:

- Maintain a strong network of real estate professionals, including agents, contractors, and lenders, to streamline future investments.

- Continuously monitor the market for new investment opportunities.

- Keep detailed records of each project to improve efficiency and profitability over time.

Advantages of the BRRRR Strategy

The BRRRR strategy offers several advantages for real estate investors:

- Leverage: By recycling your capital, you can leverage your initial investment to acquire multiple properties.

- Equity Building: Each property’s value increases through renovations, building equity that can be tapped into for future investments.

- Cash Flow: Renting the properties generates a steady income stream, improving your overall cash flow.

- Scalability: The BRRRR strategy is scalable, allowing you to grow your portfolio quickly without constantly needing new capital.

The BRRRR strategy is a powerful tool for real estate investors looking to accelerate their portfolio growth. By following the steps of buying undervalued properties, rehabbing them, renting them out, refinancing, and repeating the process, you can maximize your returns and build a substantial real estate portfolio. With diligent research, careful planning, and a network of reliable professionals, the BRRRR method can help you achieve your real estate investment goals.

For personalized advice and expert guidance on implementing your own BRRRR strategy, contact Diane Reeley today. Diane’s extensive knowledge of the local market can help you to make informed decisions and maximize your investment potential.

Start your journey towards rapid real estate portfolio growth with Diane Reeley today!